📰 TOP STORY

Mercedes F1 Boss Sells Minority Stake In Team At $6B Valuation

Toto Wolff, Mercedes F1 CEO

Toto Wolff, Mercedes F1 CEO and team principal, just cashed in.

This week, Wolff sold 15% of his ownership stake to George Kurtz, the founder and CEO of cybersecurity giant CrowdStrike.

Wolff’s ownership entity holds a third of the Mercedes team, so Kurtz, an accomplished race car driver himself, is effectively buying into one of the most valuable sports properties in the world.

Based on previous estimates, the deal values Mercedes F1 at around $6 billion, meaning Wolff walks away with roughly $300 million from the sale.

Wolff will also retain his executive roles, and the team’s governance structure will remain unchanged.

Kurtz will serve as a technology advisor and join Mercedes’ strategic steering committee alongside Ola Källenius and Sir Jim Ratcliffe.

Why Does This Matter?

When Toto bought his roughly one-third stake in 2013, Mercedes was valued at $165 million.

Today? $6 billion, more than many NBA and NFL teams.

A 3,500% increase in 13 years.

Even more wild is that this deal represents a 7x increase from the valuation when INEOS, a British chemical company, purchased its one-third stake for $128 million just five years ago.

The rise in valuations of F1 teams over the past few years is a direct consequence of the sport’s increasing global appeal and attention, including Netflix’s Drive to Survive docuseries, as well as the expansion of race destinations.

Even the Brad Pitt F1 film, released last summer, has already grossed over $630 million at the box office, shattering records on its way.

In short, F1 has been on an unreal run, driving up prices, but the question is, will it continue to do so?

Right now, Mercedes is one of F1's two most valuable teams, along with Ferrari, and like other teams, generates its revenue primarily from:

Sponsorship and licensing

Prize money

Car manufacturer funding

Similar to other sports franchises, F1 teams are typically valued based on factors such as revenue multiples, operating income, brand popularity, and scarcity.

But F1 also has a unique ingredient, the cost cap.

The cost cap limits how much teams can spend on developing and operating their cars each season.

As a result, it creates more parity, competitiveness, and makes the team businesses more sustainable while boosting valuations.

Since introducing this financial regulation in 2021, the sport has experienced more stability, making it more attractive to investors.

Given its overall thrill, storylines, and commitment to innovation, F1 is shifting racing in ways we’ve never seen before and doesn’t seem to be slowing down.

After announcing his stake in Mercedes, George Kurtz stated:

"It's a thriving business. And from that standpoint, if you have a thriving business with more market opportunity, particularly in the US, in my opinion, you're going to see valuations grow. Can it grow into something like the NBA or the NFL? I think so, which is why I invested."

And I got a feeling other investors feel the same.

💰MERGERS & MONEY MOVES

TopGolf Sold To Private Equity Firm

• Leonard Green & Partners Acquires Majority Stake In TopGolf. Topgolf Callaway Brands, a California-based golf equipment brand, has agreed to sell a majority stake in its Topgolf business to private equity firm Leonard Green, valuing the company at $1.1 billion. Topgolf Callaway will be called Callaway Golf Co. after the sale closes in the first quarter. Callaway is expected to make $700 million from the transaction, which it’ll reinvest into its other businesses, including apparel, equipment, and accessories. Leonard Green manages $75 billion in assets and has a diverse portfolio across the consumer, healthcare, and business services sectors (more here).

• Bain Capital Acquires Concert Golf Partners. Bain Capital, a global private investment firm, has agreed to acquire Concert Golf Partners, a private golf club operator, from Clearlake Capital in a transaction valued at more than $1.3 billion. The deal, which involves both Bain’s private equity and real estate investment strategies, will see Clearlake fully exit its position in Concert Golf. Concert Golf, headquartered in Lake Mary, Florida, owns and operates 39 golf club locations across the US. Financial terms of the transaction were not disclosed (more here).

• Seregh Acquires ROAR. Seregh, (pronounced "surge") a mixed-use real estate developer for sports stadiums, has acquired Revenue Over and Above Replacement (ROAR), a data analytics firm. ROAR, which will now be known as ROAR, A Seregh Company, will develop software that helps plan, build, and monetize the sports and entertainment districts. The focus will be on developing Smart Districts as a Service (SmartDaaS), which will leverage AI, machine learning, and data-driven solutions to deliver actionable insights for more effectively conceiving, developing, and commercializing Sports and Entertainment-Anchored Districts (SEADs). Financial details were not disclosed (more here).

• A-Champs Acquires Goal Station. A-Champs, a Barcelona-based sports tech company, has acquired Goal Station, a Danish innovator in smart soccer training environments. The acquisition unites the two companies to create an integrated ecosystem for cognitive, technical, and physical player development. A-Champs technology is used by more than 50% of Bundesliga clubs, over 40% of Danish Superliga teams, and clubs across LaLiga, the Premier League, and Major League Soccer. The acquisition also reinforces A-Champs’ expansion in the US. Financial details were not disclosed (more here).

• Sprocket Sports Closes Series A Round. Sprocket Sports, a youth sports club management platform, closed a Series A funding round from Frontier Growth. The company plans to use the funds to accelerate investment across its product suite and sales and service teams. Sprocket Sports combines a management and marketing platform to help youth sports clubs manage their activity. In addition to player registrations and payments, Sprocket Sports offers integrated websites, administrative and financial tools, communication modules, and a mobile app. Financial details were not disclosed (more here).

🤝 PARTNERSHIPS & COLLABORATIONS

AI-Powered Multilingual Technology Is Coming To Yes Network

• YES Network & CAMB.AI Announce Partnership. The YES Network, a New York-based regional sports network, and CAMB.AI, a global company that enables seamless multilingual communication, have entered into a strategic partnership to use artificial intelligence to enhance the fan experience. This marks the first time that CAMB.AI is teaming up with a US sports television network to explore business opportunities. The company has successfully partnered with sports leagues, including MLS and NASCAR, to break down language barriers and reach a broader audience through AI-powered multilingual translation (more here).

• MLB Announces Partnership With NBC, Netflix & ESPN. MLB announced this week that it has formed new three-year media rights agreements with Netflix, NBCUniversal, and ESPN. As part of the media rights agreements, which cover the 2026-2028 MLB seasons, the league’s longstanding relationship with ESPN will reach 39 consecutive seasons, NBC will return to regularly airing games on its broadcast network for the first time in a quarter century, and Netflix’s engagement with MLB will expand from documentaries to live baseball event coverage for the first time (more here).

• Liverpool & PayPal Announce Partnership. Liverpool FC has announced PayPal as the club’s official digital payments partner in a new multi-year deal. This marks PayPal’s first-ever collaboration with a Premier League club. PayPal plans to enhance the way Liverpool FC fans engage with the club and football experiences, both online and in-person. PayPal+, the company’s free loyalty program, where fans can earn reward points when using PayPal to pay for matchday purchases, will also be added to the experience and help elevate engagement (more here).

👀 ATHLETES & OTHER NEWS

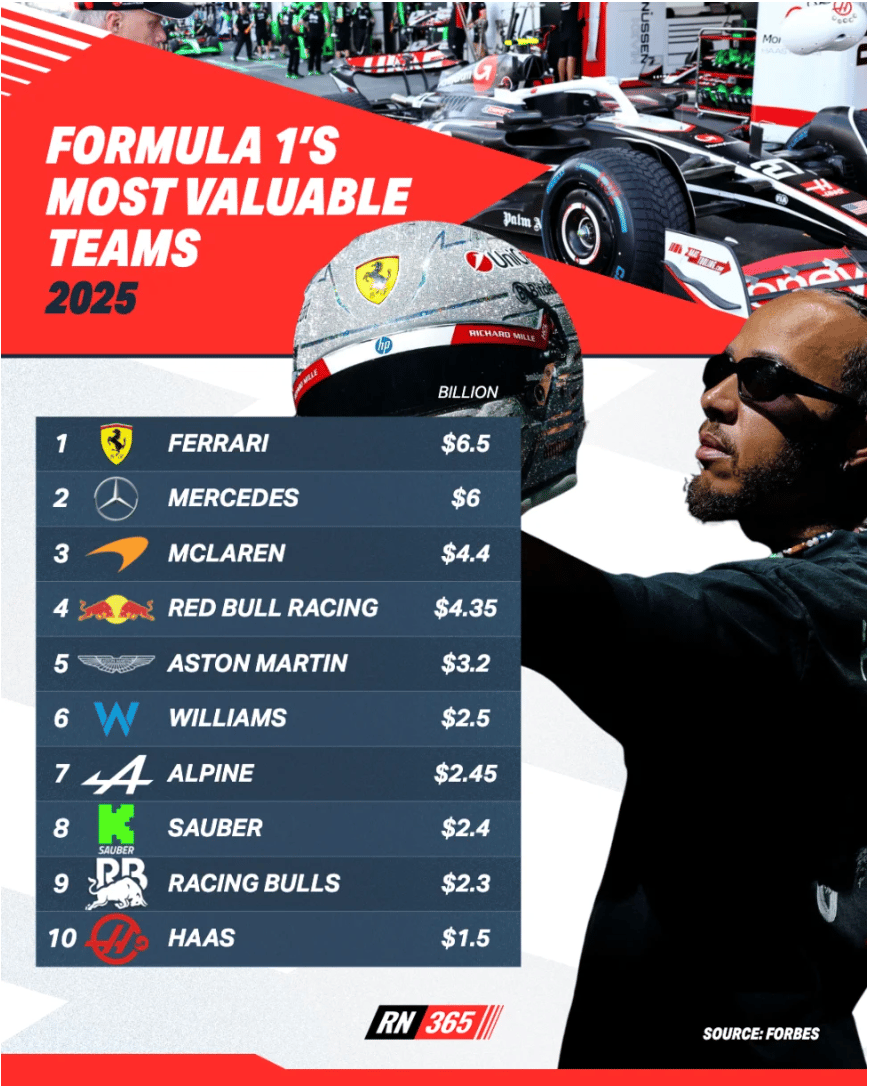

Forbes Releases F1’s Most Valuable Teams

• Formula 1’s Most Valuable Teams 2025. Across the grid, F1’s ten teams are all valued at $1.5 billion or more, and the average valuation has revved up to $3.6 billion, up 89% since 2023. That increase reflects the velocity in Formula 1’s business, with the average revenue of the ten teams reaching an estimated $430 million last year and continuing a multi-year stretch with double-digit compound annual growth rates. In light of the Las Vegas Grand Prix this weekend, Forbes released the valuations of each team (more here).

• Bank of America Partners With David Beckham. Former England soccer captain David Beckham has signed a multi-year partnership with Bank of America$BAC ( ▲ 0.55% ) to promote global sports programs ahead of the 2026 FIFA World Cup in North America. The partnership will see Beckham promote the bank's full sports partnership portfolio, which includes iconic brands and events to drive progress, achievements, and support communities. Beckham expects the World Cup to boost soccer interest in the US, where viewership has lagged behind other sports (more here).

• World Fencing League Announces Debut. This week, the World Fencing League (WFL) announced its global debut in Los Angeles in April 2026, bringing in a bold new era for the world’s enduring combat sport. The new league will combine rapid proprietary blade tracking tech, data-driven rule changes, and elite athletes to deliver a global sporting event unlike anything else. At the helm is Miles Chamley-Watson, founder, athlete, and visionary leader who has become fencing’s most recognized global ambassador. Watson is a three-time Olympian, Olympic Bronze Medalist, two-time World Champion, and first-ever African American World Champion (more here).

• TeamSnap Launches TeamSnap ONE. TeamSnap, a youth sports management platform, launched TeamSnap ONE this week. TeamSnap ONE is described as an end-to-end solution that sets a new standard in club, league, and team management. The comprehensive platform combines flexible registration, next-generation communication, team management, expert training content, live streaming, and game highlights to help clubs and leagues run and grow their organizations in a single technology platform (more here).

🎙️ PODCAST INTERVIEWS

Insights On Sports x Real Estate With Marley Hughes, CEO & Founder At Momentous Sports

This week’s guest on the Vetted Sports podcast is Marley Hughes.

Marley Hughes is the CEO & Founder of Momentous Sports and CEO of Magnolia Hill Partners, a family office with a unique focus on OpCo and PropCo investments in high-barrier sectors such as data centers and professional sports.

Momentous Sports, a division of Magnolia Hill Partners, is a global investment platform at the center of professional sports ownership and mixed-use real estate development.

In this episode, we discuss:

‣ The strategy and thesis behind Momentous Sports

‣ Where the biggest mixed-use opportunities are in the US

‣ How Marley sees real estate impacting the sports asset class

What'd you think of today's edition?

This newsletter is for informational purposes only and is not financial or business advice in any capacity. The information shared is our thoughts & opinions and does not represent the opinions of any other person, business, entity, or sponsor. The contents of this newsletter also should not be used in any public or private domain without the author's express permission.